These are fees that are deducted at the time of processing the actual transactions in respect of specific services.

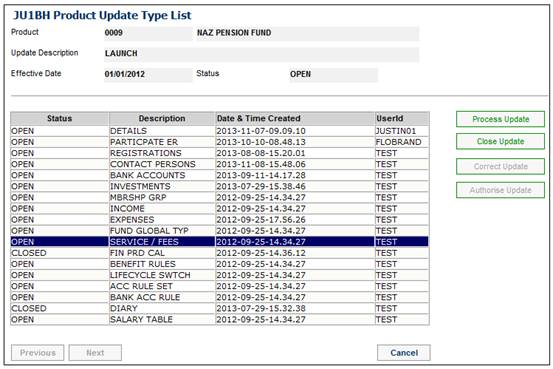

From the JU1BH Product Update Type List screen, highlight SERVICE / FEES, and click PROCESS UPDATE.

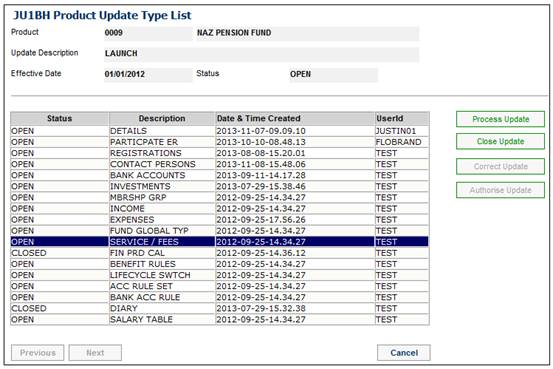

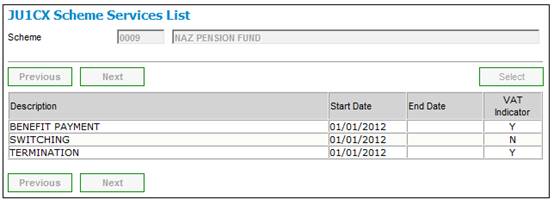

TheJU1CX Scheme Services List screen will be displayed.

Highlight a service from the list and then select Select Services from the sub-menu on the left.

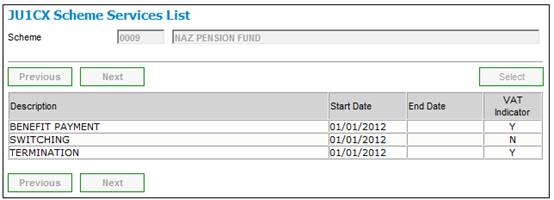

The JU1CY Select Scheme Service screen will be displayed.

The Potential Scheme Services pane on the left displays all the product services that are available for selection. Highlight the required service and click INSERT to move it to the Selected Scheme Services pane on the right. Repeat this process until you have selected all the required services.

To exit this screen, select Close from the sub-menu on the left.

![]()

The JU1CX Scheme Services List screen will be re-displayed.

Highlight the required product service, then select Scheme Fees for Service List from the sub-menu on the left.

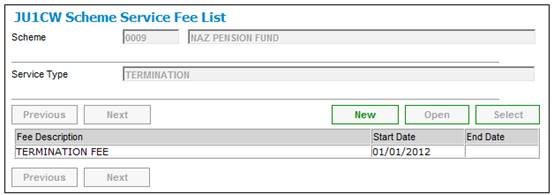

The JU1CW Scheme Service Fee List screen will be displayed.

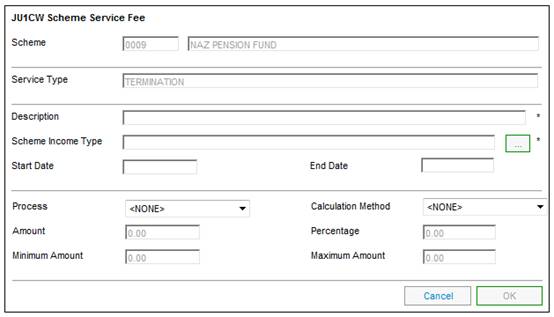

To add a new fee, click NEW. The JU1CW Scheme Service Fee screen will be displayed.

Descriptions of the input fields on this screen appear below.

|

Description |

Describes a service provided for the product and for which a transaction fee is charged. |

|

Scheme Income Type |

Click LIST at the end of the line. |

|

Start Date |

The start date of the Service Type. |

|

End Date |

The date from which the Service Type is no longer used. |

|

Process |

The specific process for which this Service Fee applies. Select a value from the drop-down box. |

|

Calculation Method |

Select a value from the drop-down box. Current values are: LAST CONTRIB AUTOMATIC OPTIONAL RECURRING TRANSACTION

Note: If the Calculation Method selected is AUTOMATIC, the Service Fee will be calculated automatically in the Automated Claims Process. |

|

Amount |

The fee amount to be charged per transaction. Note: If the value for Service Type is SWITCHING, then the Amount field will not be enabled. |

|

Percentage |

The percentage of the transaction amount to be charged. Note: If the value for Service Type is TAX DIRECTIVE, then the Percentage field will not be enabled. If the Process selected is BENEFIT PAYMENT, the Percentage field will not be enabled. |

|

Minimum Amount |

The minimum fee to be charged per transaction. Note: If the value for Service Type is TAX DIRECTIVE, then the Minimum Amount field will not be enabled. If the Process selected is BENEFIT PAYMENT, the Minimum Amount field will not be enabled. |

|

Maximum Amount |

The maximum fee to be charged per transaction. Note: If the value for Service Type is TAX DIRECTIVE, then the Maximum Amount field will not be enabled. If the Process selected is BENEFIT PAYMENT, the Maximum Amount field will not be enabled. |

Click OK to save the information. The JU1CW Scheme Service Fee List screen will be re-displayed.

Select Close from the sub-menu on the left to close this update type.

![]()

A Product Update must be done for the Products for which a Benefit Payment Fee is to be charged. Select the Service Type of BENEFIT PAYMENT and capture the Fee for the Service.

Accounting Activity

The following Accounting Activities for the creation of the Business Transaction (BT) must be created to record the Benefit Payment Fee and for the reversal of the BT if the claim is cancelled:

Fee

|

Process |

Accounting Activity |

Stakeholder |

Debit Account |

Credit Account |

|

BENEFIT PAYMENT |

BENEFIT FEE |

FUND |

BENPAYABLE |

BENPMTFEERCD |

|

BENEFIT PAYMENT |

BENEFIT FEE |

FUND |

BENPMTFEE |

BENPMTFEEPBL |

|

BENEFIT PAYMENT |

BENEFIT FEE |

MEMBER |

BENPAYABLE |

BENEFIT |

|

BENEFIT PAYMENT |

BENEFIT FEE |

MEMBER |

TRFTO/FFND |

MEMDEPOSIT |

Reversal

|

Process |

Accounting Activity |

Stakeholder |

Debit Account |

Credit Account |

|

BENEFIT PAYMENT |

BENEFITFEERV |

FUND |

BENPMTFEERCD |

BENPAYABLE |

|

BENEFIT PAYMENT |

BENEFITFEERV |

FUND |

BENPMTFEEPBL |

BENPMTFEE |

|

BENEFIT PAYMENT |

BENEFITFEERV |

MEMBER |

BENEFIT |

BENPAYABLE |

|

BENEFIT PAYMENT |

BENEFITFEERV |

MEMBER |

MEMDEPOSIT |

TRFTO/FFND |

Accounting Activity Association

Link the Accounting Activities above to the BENENHANCE Accounting Activity with a Bulk Purpose Type of BENEFIT PAYMENT.

Set up an Accounting Activity Association with a Bulk Purpose Type of COMM REPORT and link the Accounting Activities required for the Commission report as per the table below.

|

Process / Accounting Activity |

Associated Accounting Activity |

|

IND INVESTMENT / CONTRIBUTION |

MANUAL INITIATE / CONTRIBREV |

|

IND INVESTMENT / COMMISSION |

MANUAL INITIATE / COMMISSIONRV |

|

IND INVESTMENT / MEMVATONCOMM |

MANUAL INITIATE / MEMVATCOMMRV |

|

COMMISSION / MEM COMM |

MANUAL INITIATE / MEMCOMMRV |

|

COMMISSION / MEMANNCOMVAT |

MANUAL INITIATE / MANNCOMVATRV |

For details of the Commission Extract for all products, refer to

System Reports

General

Commission

For details of the Tags for the Document Template associated to the PDF Process Type of COMMISSION refer to

Supplements

Tags

Tags for Commission

When the acceptance fees on the investment amount for new beneficiaries are calculated, the expense rule for which the FORMULA APPLIED TO is INITIAL INV AMT for the benefit membership group to which the member is linked will be read.

The MEMINVADMFEE business transactions with the expense type to which the expense rule is linked, will be created.

Note:

Currently the fee is calculated using the expenses rule for the membership group to which the member is linked. This means that a fee will be calculated for every expense rule linked to the membership group. It is necessary for some fees to be calculated via expenses billing, and therefore it is necessary to be able to identify those to be used when the initial fee is calculated.

For details of the calculation and processing for Expense Billing using the JU3BH_BILL Expense Billing batch job, refer to Processing under

Processes

Expense Billing

Expense Billing

New

For details of the calculation and processing for Expense Billing using the JU3BR_COMM Commission Billing batch job, refer to Processing for commission billing under

Processes

Expense Billing

Commission

New